- TOP

- Investors

- Management

- Management Plan (Long-term, Medium-term)

Management Plan (Long-term, Medium-term)

Our Mission is to use the diverse talents of our people and our Core Technologies as an engine for growth to create highly competitive, feature-rich products and services that offer value to customers and contribute to better lives for all.

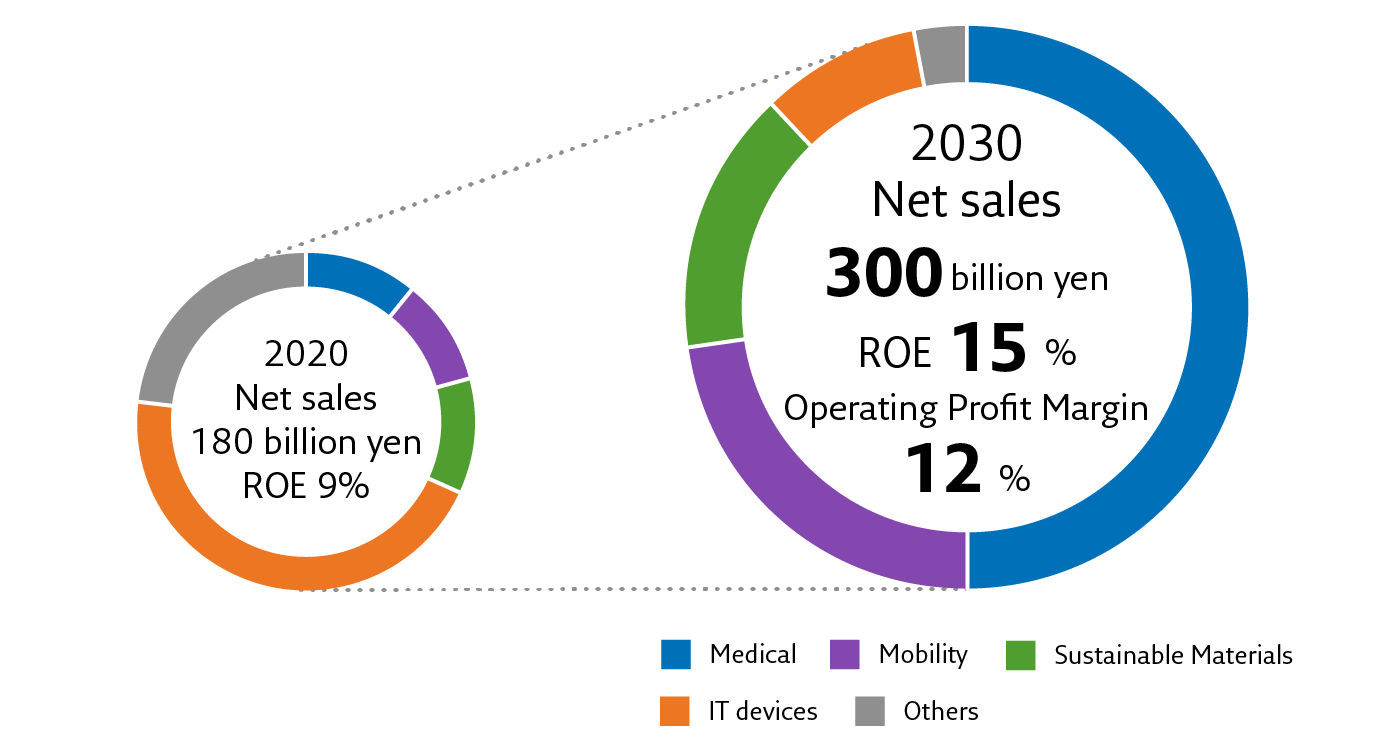

Guided by this Mission, we have established Sustainability Vision as our long-term vision for 2030. Correspondingly, we have been operating the 8th Medium-term Business Plan, that sets our medium-term strategy for the 3 years from 2024, reflecting backwards the Sustainability Vision.

Guided by this Mission, we have established Sustainability Vision as our long-term vision for 2030. Correspondingly, we have been operating the 8th Medium-term Business Plan, that sets our medium-term strategy for the 3 years from 2024, reflecting backwards the Sustainability Vision.

Sustainability Vision

With the integration and orchestration of the diverse talents of our people and our technologies, we will contribute to solving global social issues in the priority markets of Medical, Mobility, and Sustainable Materials, and realize the enrichment of people's healthy and affluent lives.

Social value

- Solve social issues through business activities

- Solve medical issues, realize safe and comfortable mobility, and contribute to a circular society

- Reduce 30% of total CO2 emissions, in view of carbon-neutral by 2050 (compared to 2020)

Economic value

The 8th Medium-term Business Plan

We have been currently operating the 8th Medium-term Business Plan (3 years) since January 2024, aiming at fulfilling our Sustainability Vision for 2030. In the 8th Medium-term Business Plan, we will boost profitability and stability through strengthening our business portfolio we have built so far, placing great importance on achieving stable growth and enhancing capital efficiency. In the markets of Medical Devices, Mobility, and Sustainable Materials, our goal is to achieve organic and inorganic growth, expanding product/service line-ups that will solve social issues. In the IT devices market, we will enhance profitability and efficiency, including operational optimization.

Furthermore, in order to ensure sustainable growth in the future, we will accelerate the development of new businesses and products, not only through our own development but also through business partnerships and M&A.

Furthermore, in order to ensure sustainable growth in the future, we will accelerate the development of new businesses and products, not only through our own development but also through business partnerships and M&A.

Accelerating growth in 3 priority markets of non-IT devices

Improving profitability and stability

Medical

Mobility

Sustainable Materials

Strategy of the 8th Medium-term Business Plan

| Business portfolio management | Exploitation of business portfolio management | Prioritizing ROIC improvement, guided by disciplined business decision-making |

|---|---|---|

| Star: Accelerate | Simultaneously facilitating business growth and stabilizing profit margin, leading the enhancement of corporate value

|

|

| Cash Cow: Pursue profitability | Striving for productivity and efficiency, creating cash that fuels growth investments

|

|

| Problem Child: Prove business potential | Aiming for continuous growth by nurturing next stars in future

|

|

| Cash allocation | Growth investment | Focusing on accelerating the growth of Star businesses, proactively leveraging M&A |

| Shareholder returns | Maintaining steady dividends, potentially increasing dividends according to performance improvement, and flexible share buybacks | |

| Initiatives enabling business portfolio management | Pursue profitability and efficiency | Quality and production strategy to generate profit |

| Human capital | Human capital enabling business portfolio management, and promotion of human resource diversification | |

| Responding to climate change | Reduction of total CO2 emissions |

Financial Plan

| (Millions of JPY) | The 8th Medium-term Business Plan | |||

|---|---|---|---|---|

| 2024 Plan | 2025 Plan | 2026 Plan (Not including M&A) |

2026 Plan (Including M&A) |

|

| ROE | 3.3% | 5.9% | ✔9%+ | 9%+ |

| Net sales | 186,500 | 193,500 | 210,000 | 225,000 |

| Operating profit (Operating profit margin) |

5,800

(3.1%)

|

9,000

(4.7%)

|

15,000

(7.1%)

|

16,500 (7.3%) |

| 3 priority markets of non-IT devices Operating profit (Operating profit margin) | 6,250 (5.7%) |

8,700 (7.5%) |

13,000 ✔(10.2%) |

14,500 (10.2%) |

| Forex | ¥135/$ | ¥130/$ | ¥130/$ | ¥130/$ |